The Parent Trap

Capital & Interests: The creation of the ultimate frozen threshold.

Harry Arnold 14 05 2024

WHAT is going on?

My wife works in public policy, and I’ve learnt to look forward to her nightly report, in which she offers me some insight into the way various government sausages are made. It appears creating policies that make everyone happy is either impossible, highly implausible - or completely unaffordable. In this first instalment of Capital & Interests, it’s the subject of affordability that I’d like to shine a light on.

Last month’s widely publicised rollout of the government’s ‘free childcare’ offering contains a clause that many hard-working families are likely to find frustrating and disappointing, given the considerable financial strain the cost of childcare puts them under; the exclusion of any and all support if one parent earns over £100,000. No tax-free childcare, and no free hours until the child reaches 3.

£100,000 is a large annual income, and perhaps you’re of the belief that it’s not the responsibility of the taxpayer to support the richest among us. But although £100,000 sounds like a lot of money, let’s consider it within the context of a London housing market gone mad, where people are expected to find half-a-million to buy a garden flat with rising damp and poor transport links . £100,000 just isn’t what it used to be.

This is especially true if you don’t count yourself among the growing number of millennials inheriting baby boomer wealth. These days, this cohort could be looking down the barrel of a fairly large mortgage, in an elevated interest rate environment, to buy a pretty standard house south of Watford. For a generation born into the “End of History”, who have likely followed the New Labour path through university in order to secure a “high paying job of the future”, this is a fairly bitter pill to swallow. Let’s not forget their student loan payments, currently sitting at 7.8% for a plan 2 loan.

HISTORY

It was the late Alastair Darling - as I write this, the last Labour Chancellor - who introduced the £100,000 threshold in 2009, when it was decreed that anyone earning over this sum would start being denied a personal allowance, thus creating the dreaded 60% tax rate and it has not moved an inch since. According to Nationwide’s House Price Calculator, in the fifteen years that have passed since this decision, house prices in London have risen by 102% and according to the Bank of England’s own Inflation Calculator, goods and services that would have cost you £100,000 in 2009 will now cost you £153,670. This is the ultimate frozen threshold.

the effect

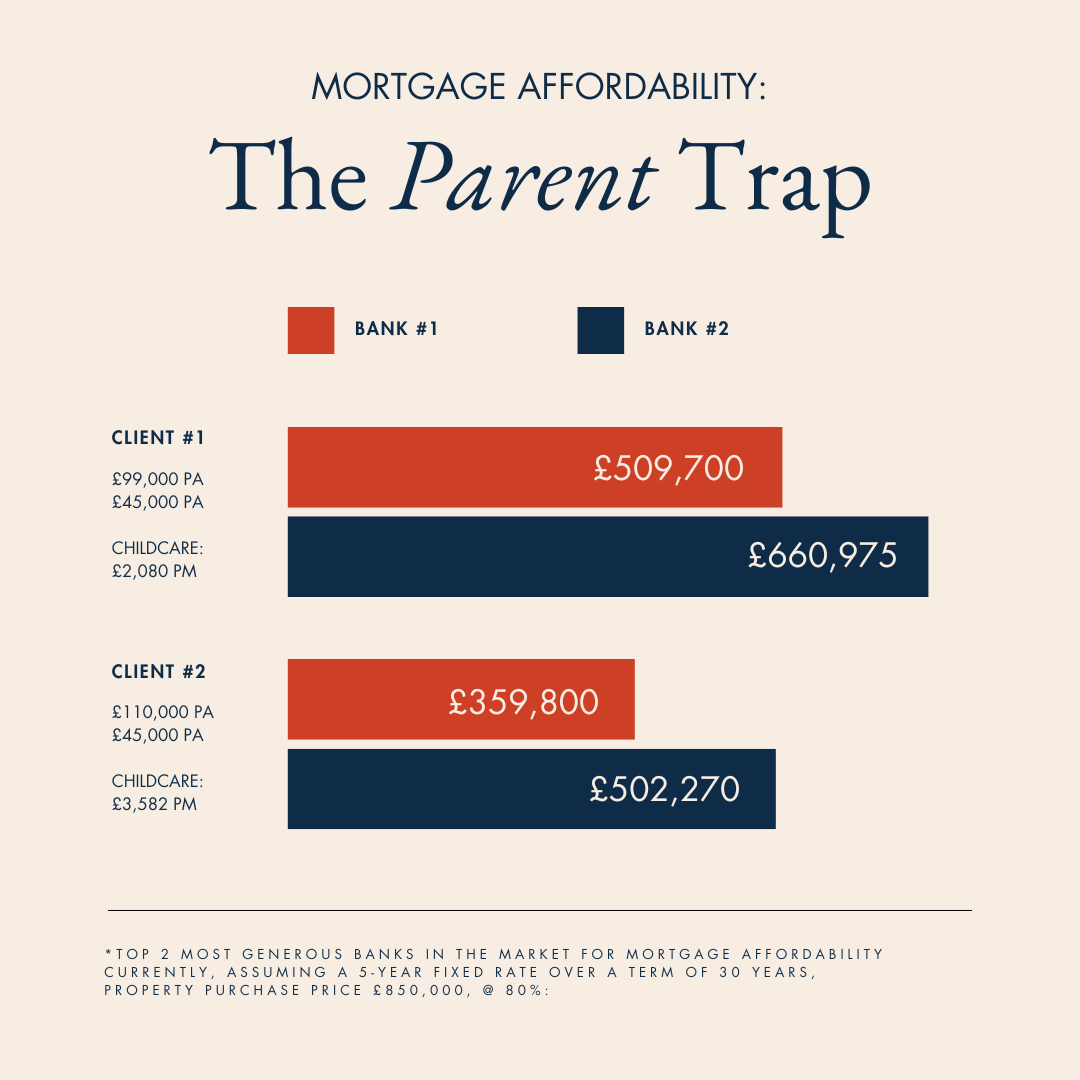

After an internal analysis of the two banks who currently have the most generous affordability calculations on the high street, we also found that this removal of support has a profound impact on mortgage affordability for higher earners. If you’re receiving no government support, an example cost of full-time nursery based in a South London borough (mine, actually) for two children under the age of three comes in at £3,528 per month.

For a partner of someone exceeding the £100,000 threshold, assuming they make a 5% pension contribution and have a plan 2 student loan, this £3,528 figure is the rough equivalent of the net monthly salary of £64,000 per annum. The uncomfortable reality is that unless the second earner exceeds this level of salary, there’s little point in them working and the family committing to these childcare costs. Another striking point with regards to mortgage affordability is that in our model, only when someone is earning £145,000 and not receiving the benefits would they be able to borrow more than someone earning £99,000 and receiving their full childcare benefits. That’s a 46% gap.

This is a metropolitan problem, yes - but it’s one being faced by the people in our society that we hold up as aspirational role models. Hard-working families, making it on their own with little to no parental support. High-earners who have worked their way up to a “high paying job of the future”, and, with house prices where they are, significant mortgages.

how we can help

As we navigate the market, it’s increasingly obvious that generic solutions rarely meet specific needs. At Anderson Harris, we understand unique circumstances, and we’re committed to providing bespoke financial solutions that align with your needs. Whether you’re grappling with the challenges of mortgage affordability, or seeking strategic advice on how to manage your finances amidst new policy changes, our team is here to guide you.

Reach out for a conversation with one of our advisors today, so we can explore the options available, and discuss how we can tailor our services to support you.